- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

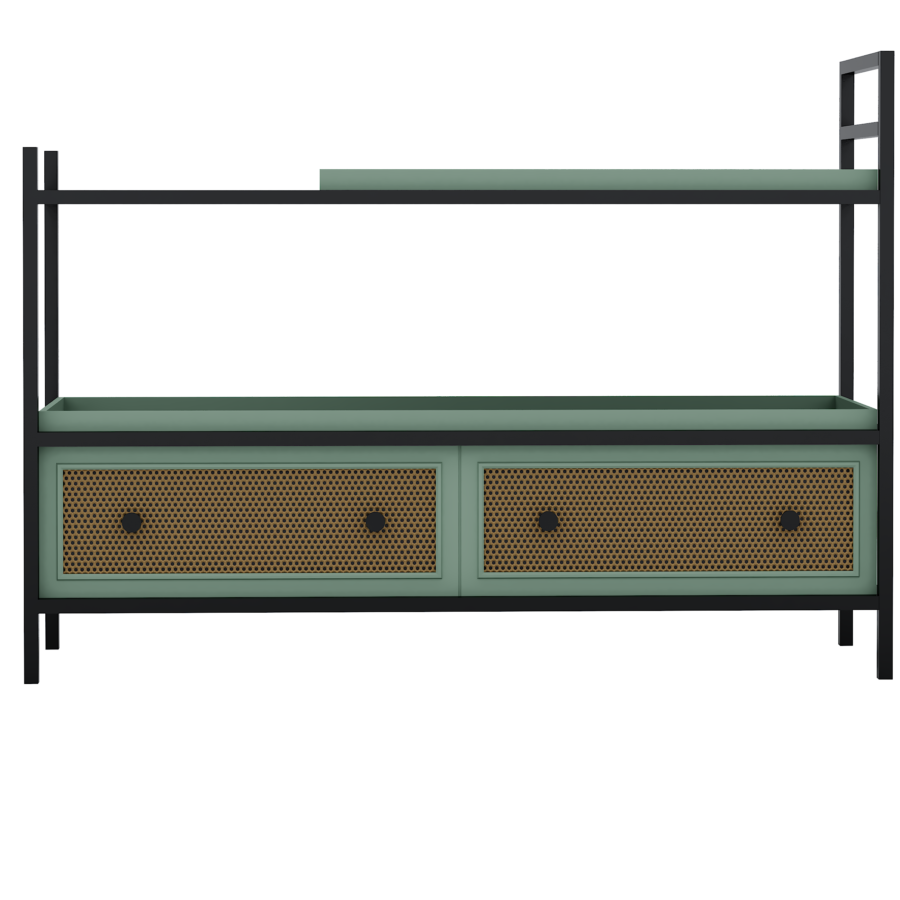

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺42,560.00₺34,144.50

-

- Yaşam Tarzı

Poor credit And need A property Upgrade Mortgage? You will find A method

That have invested several years of lifestyle when you look at the a home, a feeling of freshness fades aside. Wall structure peel-offs, doorways breaking audio when swinging backwards and forwards to your rusty hinges, patches from seepage, fractures and you will payday loans Libertyville tiny holes in doorframes, heavy gooey grime ingrained during the cupboard handles, and other problems that fundamentally it seems like you are surviving in a beneficial ramshackle building.

Recovery ‘s the option to restore the fresh new forgotten soul of your own house, nonetheless it eats right up a fortune. Despite offers, you may have to sign up for a property upgrade mortgage. Since these funds commonly very quick, it could be difficult to obtain the nod when you yourself have a poor credit rating.

Several lenders will straightaway refute your financing money when your credit score is abysmal, but there is however nevertheless a possibility to get home improvement finance that have poor credit.

The feeling away from a poor credit score on your do it yourself mortgage

Before you can smart to the options available to you, you must know exactly how a dismal credit declaration can get a keen influence on your own borrowing potential.

There is multiple things about a woeful credit get, however when your own borrowing from the bank facts was below average, they points out one thing only: you are a beneficial riskier borrower. This could dictate the option of financial on the terms and conditions it could possibly offer your. A bad credit get doesn’t always dissuade you against being qualified for a loan, but the offer you are given may possibly not be that glamorous. This is because apparent you to definitely loan providers need certainly to all the way down their chance if you refute otherwise are not able to conform to money.

Even although you normally be eligible for a house improve mortgage, it is worth taking into consideration should it be worthwhile. Including, examine whether or not the particular renovation we should use up will add really worth to your residence.

Exactly what do you will want to be eligible for a house upgrade financing with poor credit?

Ideally, unless it is urgent, you may like to hold off before taking out a loan in order to refurbish your home, as this provides you with plenty of time to do-up your own credit score. If you can’t wait, you will need to meet with the adopting the standards:

step one. Establish collateral

Property improvement loan try a consumer loan offered the new borrowing sum is not all that high, plus it utilizes new formula out of lenders during the what sum it place a limit into the, beyond that it will get a protected mortgage. Because your paying capability has already been concerned, a loan provider will most likely not ask you to lay out security actually if you don’t borrow outside the capped limitation. The size of the borrowed funds is brief if you tend to help you qualify for the borrowed funds instead of getting off coverage. New collateral will probably be your domestic, meaning if you fail to pay back your debt, you’ll end up shedding your residence.

Since you lay out your residence just like the collateral, this minimises the risk of the lender, which, they’ll most likely accept you a higher sumpared to help you small-identity funds, the sum was big, thus, the new percentage several months might be lengthened. How big is the fresh payment title depends upon debt affairs. In case the financial predicament is good, possible manage larger money, nevertheless when the month-to-month instalments try brief, you will be linked with your debt having a extended months. Quite simply, you are paying interest for a longer period.

dos. Program a guarantor

A loan provider may ask you to program an effective guarantor as well. It is particularly appropriate in case the collateral yourself is actually not as large. An effective guarantor is a 3rd person that are going to be individuals, including your spouse or other loved one, with a good credit score. That it reduces the risk of the financial institution because the guarantor commonly be responsible for clearing your debt when the borrower doesn’t agree to new commission conditions and terms.

You will need to remember that guarantor loans commonly secured loans. Your house does not serve as security. Since you strategy an excellent guarantor, you are going to qualify for lower interest levels. Before taking out property improve loan having a great guarantor, make sure regarding the paying off ability. Your own defaults often change the credit history of one’s guarantor while the better.

step 3. Finest selection that you should believe

If you want financing into the Ireland to-do up your domestic plus credit rating was crappy, you should consider another choices:

- You should ask your home loan company if they mortgage you much more about your existing financial. The attention prices will vary to that of your home loan, nonetheless they remain down. You can get next straight down rates for many who perform opportunity-efficient repair. Bear in mind that the lender is going to run credit checks and you will affordability checks. Advance isn’t an alternative in the event your home loan is already inside arrears.

- A great remortgage is additionally an alternative. Remortgaging makes you pay-off your financial since your repaired appeal-rates several months comes to an end and you may enables you to acquire way more than just you’d together with your prior mortgage. The extra share might be used to renovate your home. For those who failed to make repayments inside repaired several months offer, you might rating straight down rates, as your credit score will have improved as well.

- Unless you you need a big sum, you need to use your own mastercard. This can be great for small restoration plans, but before with this particular alternative, understand how your own mastercard works.

To help you wrap-up

You could take out property upgrade financing which have bad credit, however your lender you will request you to establish collateral otherwise arrange a great guarantor. This package might be costly once the risk can not be counterbalance because of the implies.

Consider most other solutions instance looking to advance out of your mortgage lender and you may remortgage. These solutions will require a credit score assessment. For this reason, the reality that of the matter is you will need a great good credit score whatever the financing you apply for renovation of your property.

Caleb performs since an older author from the Financealoan towards the earlier in the day 3 years. He or she is an authorship enthusiast and you can invests a great time for the examining and discussing financial style. Their keenness from inside the investigating a subject to make research-depending section is simply unrivaled. The guy believes when you look at the along with a surface out-of authenticity having real-date advice and you may affairs.

Caleb’s articles and you can posts tell you strong-resting knowledge and expertise. His educational qualification models the base of their excellent control of the and Jargon. He is an excellent postgraduate in the Fund which will be already employed in exploring the world of the stock market.