- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

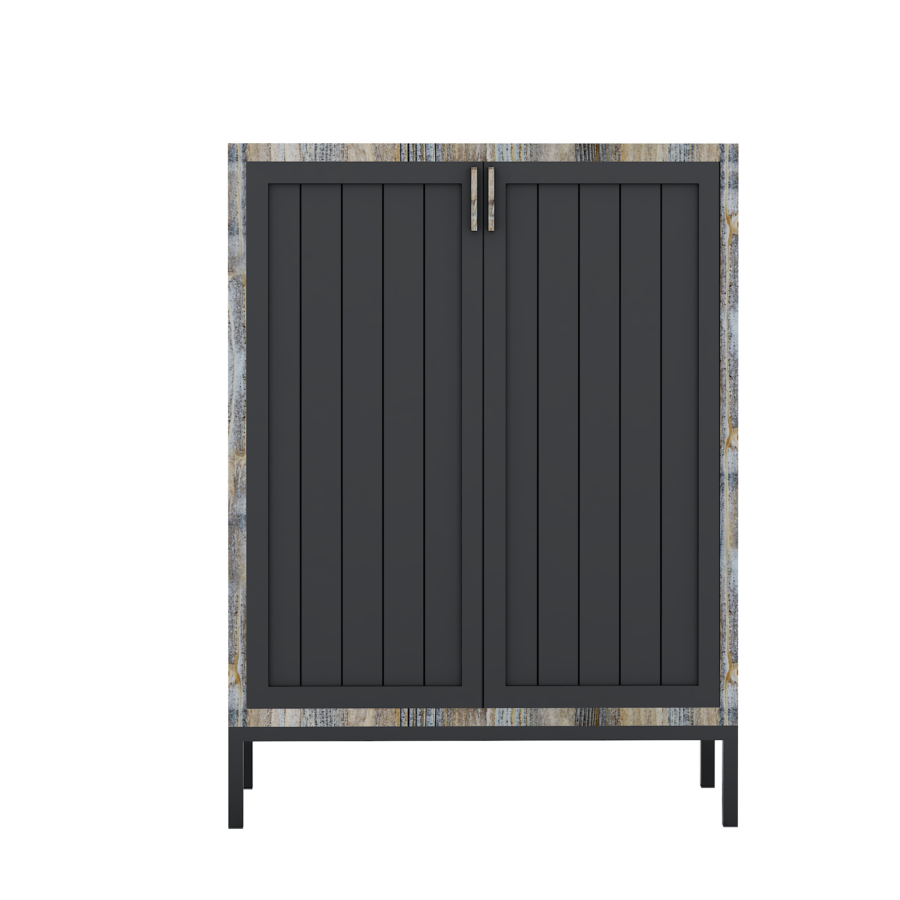

Ladin Dolap

Ladin Dolap

₺40,280.00₺33,150.00

-

- Yaşam Tarzı

5. Your failed to meet up with the earliest software conditions

Shortly after looking at the financials, their bank will establish the absolute most they have been ready to ensure it is you to obtain. Which contour is generally for how far you could potentially conveniently be able to repay every month when you take your current money top and you can debt burden into consideration.

For many who request to get a personal bank loan which is large than simply you can feasibly carry out, the lending company could possibly get deny the application completely. In the place of targeting a top count, it’s a good idea becoming practical and ask for a loan amount one makes sense given your financial situation.

As well as form specific economic eligibility criteria, most https://paydayloancolorado.net/rye/ loan providers together with supply several earliest qualifying conditions you can must meet to become regarded as a borrower. All the lender’s conditions would-be a bit some other, in general we offer the following:

- You really must be of your own period of vast majority on your own condition (typically 18).

- You truly must be a good U.S. resident otherwise being qualified citizen.

- You may have to keeps a long-term address and you may savings account.

- Needed a functional email address.

Or even make certain you meet with the first conditions before applying, you’ll getting declined to possess a personal bank loan.

six. The loan software was completely wrong or unfinished

In addition to the app in itself, you will probably be anticipated to submit particular help documentation, such as for example W2’s, lender comments or taxation statements. This short article facilitate the lender make choice. Without it, they don’t have the ability to build an educated dedication on the whether or otherwise not you be eligible for financing.

Make sure to read over the application to catch one problems before you apply to your mortgage, and make certain that you are entry a correct information before you could send everything in. Additionally help label the lender and you can twice-be sure he’s got what you needed after you have sent in any material.

7. Your loan objective didn’t match the lender’s standards

Possibly loan providers might impose fool around with restrictions, or constraints about how you are able to your loan fund. Eg, of numerous loan providers do not let its unsecured loans for use so you’re able to safeguards degree will cost you or organization costs.

Be sure to take a look at lender’s terms and conditions to verify you to you want to use the funds from the loan having an approved goal. If not, the job might possibly be rejected.

Tips change your likelihood of delivering recognized for a loan

In the event the personal bank loan software was declined, don’t get worried. You can find activities to do to better your odds of being qualified the next time you ought to borrow some funds. Is a glance at what you can do to tilt brand new opportunity on your side:

step one. Make your credit history very first

If you were declined the loan because your credit rating are also reasonable, a very important thing you can do is actually build your credit score before applying again.

- Look at your credit file for your errors and you can conflict all of them.

- Help make your costs on time every time.

- Use the personal debt snowball or obligations avalanche answers to repay credit debt.

- Anticipate bad things to drop-off your credit history.

- Apply for the fresh new types of borrowing sparingly.

2. Change your DTI ahead of time

On the other hand, whether your obligations-to-money proportion try the cause of their denial, you have got one or two options to increase it. You may either boost your earnings otherwise lower the money you owe. However, doing each other will most likely have the greatest impression.

Utilizing the example in the DTI part over, for people who improve your earnings so you can $6,000 30 days and you can lower your current debts to help you good overall of $2,000 30 days, your brand new ratio could be 29%, which is better when you look at the regular credit assortment.