- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

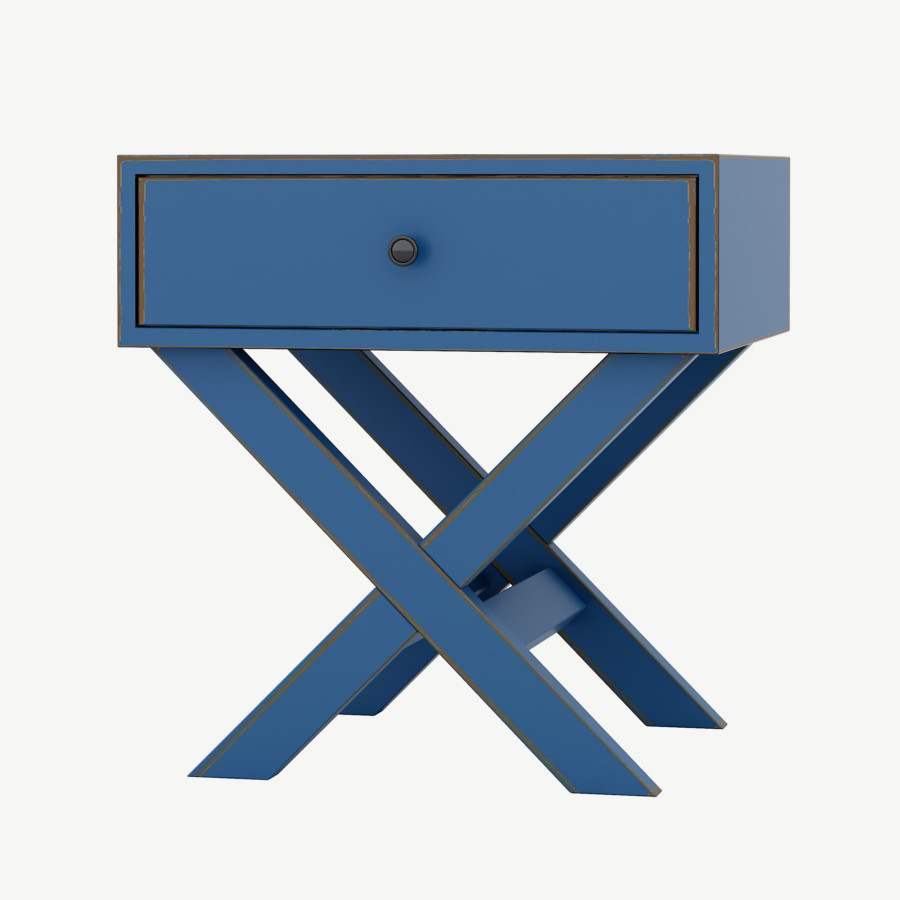

Piccolo Komodin

Piccolo Komodin

₺22,420.00₺16,575.00

-

- Yaşam Tarzı

Should i score a personal bank loan that have a good 696 credit history?

Sure, you should face absolutely nothing difficulty in qualifying to possess a home loan which have their 696 credit score, given your revenue, employment condition, and you can possessions be considered. Compliant mortgage loans (antique money one to meet with the conditions away from Federal national mortgage association otherwise Freddie Mac) want a score off 620, while FHA mortgage loans with low-down repayments wanted a 580. Your score conveniently is higher than both thresholds.

Yet not, you’re impractical to help you qualify for a beneficial lender’s better mortgage prices. Lenders generally put aside their top rates having borrowers which have decent or exceptional credit scores. However, which have an excellent 696 credit score, you need to qualify for prices that line up having national averages.

At exactly the same time, just remember that , the low your credit score, the higher loan providers get anticipate the rest of your official certification to help you getting. For example, based on Fannie Mae’s current lending conditions, you might safer a mortgage which have a loans-to-earnings ratio (DTI) of up to forty five% and you may a simple 20% down payment if for example the credit history is over 720. Or even, your own DTI was capped from the thirty six%.

Getting an unsecured loan that have a beneficial 696 credit score can be done, not all lenders could possibly get agree your application. Particular loan providers want results better on the 700s to possess idea. Although not, according to the financial, you may still safe a consumer loan which have competitive conditions.

Upstart-pushed signature loans mainly target consumers just who will most likely not has actually finest-level borrowing from the bank but they are deemed creditworthy based on non-old-fashioned activities. And this, you may want to understand more about your loan selection if you are regarding the business.

Take your 696 credit rating having a grain regarding salt

As mentioned earlier, there is no universal concept of an excellent ‘good’ credit history, and different lenders use fico scores in their lending behavior so you’re able to differing amounts. Zero metric, such as the widely-put FICO Get, can flawlessly assume consumer conclusion. Indeed, a 2021 research by the professors at School away from Pittsburgh located you to definitely conventional credit reporting misclassified standard exposure for approximately 30% away from consumers, especially all the way down-earnings and you will younger someone.

Upstart, specifically, aims to appear beyond a borrower’s credit score and you can takes into account the newest comprehensive image of its financial and you can life situation. This method will promote qualified individuals with reduced-than-greatest credit scores the means to access the fresh credit opportunities needed and deserve.

How can i elevate my a good credit score loans in Rockvale get to great?

That have a great 696 credit history, you are conveniently based over the field of bad credit, however, you’re however in the middle of the fresh new prepare. When you’re looking to boost your credit rating, here are a few wise procedures to look at. Keep in mind that all individual is exclusive, and their credit history may vary, however, listed below are some things to bear in mind if you aspire to alter your credit rating.

- Keep the credit application lower. Because the prominent suggestions is with below 30% of your own readily available borrowing, those with a beneficial FICO Score out-of 795 or maybe more generally speaking make use of just 7% of their offered borrowing.

- Merely submit an application for brand new borrowing from the bank when needed. Tough borrowing from the bank inquiries made within the last one year may have a bad effect on the score, and you can recently established profile may apply at it.

- Allow your credit rating in order to decades. The common individual which have good FICO Get a lot more than 795 retains an membership period of up to several decades. Credit score length accounts for 15% of FICO rating, thus, for these installing credit, one of the best an approach to boost your credit file and you can in order to get a higher credit rating is to be patient.

- Ensure quick statement repayments. Fee records is important; 96% out of people that have Credit ratings significantly more than 795 have-not already been outstanding toward a credit account.