- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

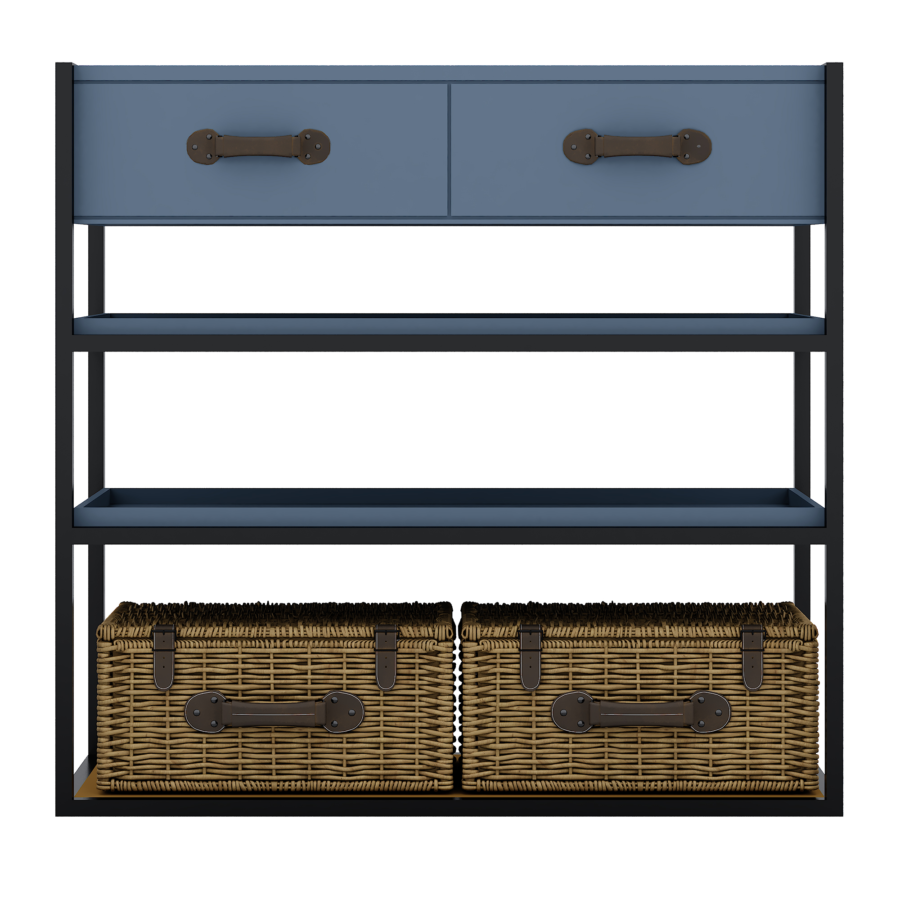

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

Does obtaining financing apply to your credit rating?

If you are searching to own a fast answer: Sure, trying to get an unsecured loan calls for an arduous credit browse that may has actually an initial-label impact on your credit score. If you choose to score a personal bank loan this can subsequent connect with your document. It will improve your personal debt-to-earnings proportion which is a cause of a lender’s affordability inspections. But not, a loan can also change your borrowing mix which help your to improve your credit history. So, if you pay the loan on time per month and you may show you could potentially handle debt sensibly, you may find one to taking right out a loan can have a confident consequences on your own credit history.

Contained in this guide, we describe as to the installment loans for bad credit in Massachusetts reasons applying for that loan make a difference to their borrowing from the bank get and exactly how better to screen and manage that it.

How come a credit history really works?

A credit history is essentially familiar with anticipate how almost certainly your should be pay the money you lent. This will help to loan providers decide which programs to accept, and you will what price giving.

Whenever you are credit ratings are not common, they’re regularly make you a general notion of how likely youre is accepted to have borrowing. Additional organizations provides their own rating possibilities to assist them to dictate whether or not one is the right complement a particular tool, no matter if so never get a credit score the thing is online since the gospel.

Having said that, most organisations use comparable things to exercise your own borrowing get. Therefore it is secure to visualize that when something affects the borrowing report (i.age. failing continually to make your home loan repayments) this is certainly shown in your total credit history too.

Advice out of your credit file is often used to develop your rating. Things for example just how you addressed debt prior to now, your recent monetary and private things, and you can quantities of loans are typical going to have an effect on the credit rating.

Since your creditworthiness is actually a key factor in one lender’s decision-and also make techniques, you should be alert to people step that’ll impact your own credit history plus trying to get borrowing otherwise trying out any extra loans. This may connect with your ability so you’re able to use both in the brand new small and you may long haul.

Wisdom credit file and credit site agencies

A credit report is track of the way you normally would your bank account, giving an in depth writeup on your credit score. It will help money company to see which form of buyers your would be (i.age. regardless if you are browsing pay the bucks you have borrowed for the time).

Credit reports manufactured by credit resource providers (CRAs) by the putting together a combination of public records and borrowing from the bank suggestions held in regards to you of the loan providers. Part of the around three CRAs to understand is Experian, Equifax and you will TransUnion.

Finance company and you will lenders are after that able to use what provided by CRAs to run affordability and borrowing from the bank exposure checks, helping all of them make a decision in your borrowing software.

The information found on your credit report is even employed by loan providers and CRAs to help you calculate your credit rating. Hence, once you sign up for a consumer loan or take out borrowing, that is submitted in your credit history and thus can get feeling your credit score afterwards.

Hard hunt compared to flaccid hunt

Once you make an application for a financing tool which is many techniques from a cellular phone deal in order to a good loan a delicate or tough borrowing from the bank search might possibly be conducted. This will help new loans vendor otherwise bank choose whether or not they have been able to offer you the item.