- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

Ladin Vestiyer Dolap ve Bench

Ladin Vestiyer Dolap ve Bench

₺76,000.00₺62,985.00

-

- Yaşam Tarzı

Knowing the Fed’s Rate Clipped and exactly how It Impacts Your own Mortgage and Funds

After you discover your ideal home, the new agent makes a deal one brings the vendor on your behalf. The real property representative knows tips design the fresh new offer, along with contingencies which should be accomplished until the offer are closed. This consists of:

- Appraisals would be near the loan amount.

- Checks of the house will be accomplished to be sure truth be told there are no major property items.

- Individuals get financial support

This is important due to the fact contingencies include the customer and their serious money. Serious cash is a deposit one to confirms on vendor you to definitely you’re an eligible and committed domestic customer. More over, since the terms of the house-to get deal is actually acknowledged, both sides must signal the acquisition agreement to go forward to the next step.

eight. Open Escrow

Generally we should focus on the lending company exactly who preapproved your; they already fully know you and the method might possibly be timely. Your lender will show you various form of mortgages like Antique, FHA, Jumbo, and Va, to name a few. Also, expect you’ll present upgraded files as needed. New paperwork you provided inside the preapproval techniques manage recently become outdated right now. At this time, the lending company offers financing imagine summarizing another:

- Mortgage title

- This new estimated closure price of the fresh new escrow

- Interest rate and Annual percentage rate

- Monthly payment considering taxation, desire, principal, and you may insurance coverage

- Estimated money had a need to personal

8. Financial Processing and you will Underwriting

At this stage, the mortgage processors collect all of your advice and you can records throughout the bank and concerning the assets, that is put together towards financing plan. It is then sent to the latest underwriter, whom evaluations the container and you may decides whether to refuse otherwise deal with the loan application. Take note, in case your software program is recognized, the next phase is to lock the mortgage interest rate. There’ll also be an appraisal and you can an evaluation held on the the house or property to make sure you are to invest in a house which is worthy of the asking price.

nine. Pre-Closing

Just before closing, we possess the pre-closing step. That is where the latest name insurance is purchased, and is ensured that most the fresh contingencies are came across. Second, brand new closure is scheduled.

10. Closing

Ultimately, you’re prepared on closure table and signal this new data to know the homeownership fantasy. Once you come to possess closing, carry a couple of forms of ID and plan big date into the escrow administrator to go over the method immediately after possession. This is basically the last step whenever providing home financing inside the California.

For more information otherwise assistance with the house financing processes, call us. Our company is masters and will help you effortlessly and seamlessly navigate the process.

Dreaming off homeownership however, worried about the fresh advance payment difficulty? Great! You will find several reasonable in order to zero downpayment choice that can turn the homeownership fantasy to your possible. Let’s discuss homeownership https://paydayloancolorado.net/frisco/ that have reasonable so you can zero deposit options and you can know how capable generate home ownership much more accessible than just you believe. […]

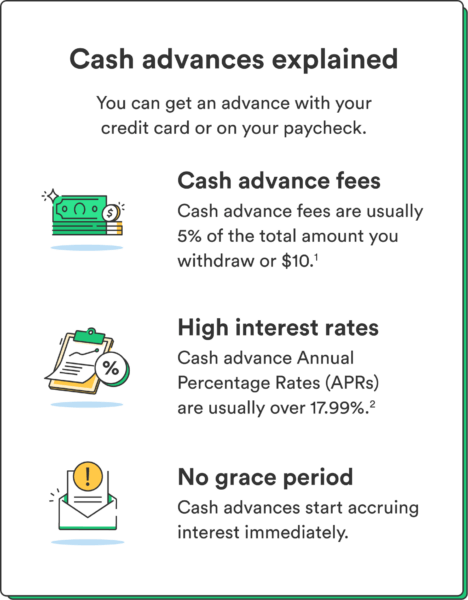

Brand new Government Set-aside (the Fed) usually changes interest rates so you can influence the brand new savings. This may affect the financial, funds, and full finances when the Fed slices costs. And therefore, knowing the Fed’s Price Cut helps you make advised decisions concerning your finances. Straight down Home loan Costs Could Follow the Fed’s speed cut will not in person apply at

Benefits of Refinancing Their Home loan Getting Less Speed

Refinancing the mortgage will be a smart monetary disperse. It allows one take advantage of most useful rates. In that way, you can save money and you can change your total financial predicament. Ergo, check out secret benefits associated with refinancing their financial to possess an effective down price. Down Monthly installments One of the main advantages of