- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

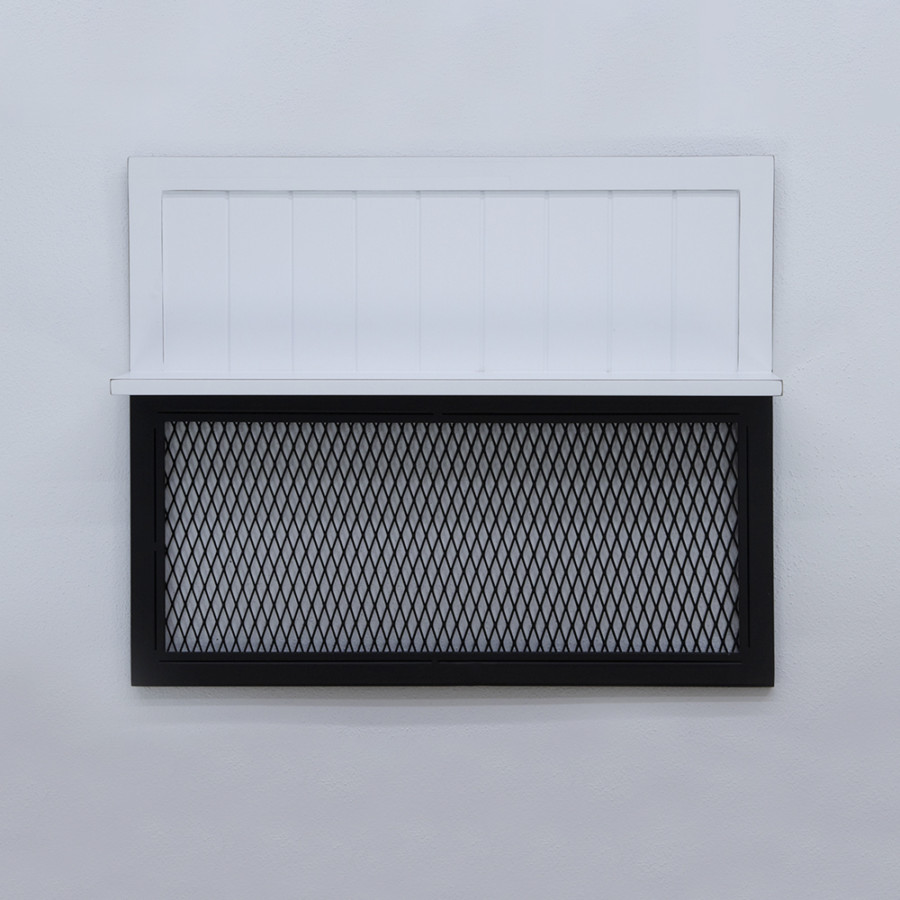

Hammond Duvar Rafı

Hammond Duvar Rafı

₺13,376.00₺10,342.80

-

- Yaşam Tarzı

Virginia FHA Fund Provide the Secrets to Homeownership

Purchasing a home was a dream for almost all, nonetheless it can seem to be out of reach, especially if you will be an initial-time homebuyer. When you are navigating the new housing industry, you’ve likely heard of FHA lenders. The new FHA financial remain the best a home loan selection for first-time people from inside the Virginia.

The application form was designed to create homeownership more available through providing restricted deposit standards. It is specifically helpful in more costly housing places particularly city DC where in fact the median house speed already is higher than $610,000. But how carry out FHA money performs, and tend to be they the proper fit for your? Why don’t we falter everything you need to know.

What exactly is an enthusiastic FHA Mortgage?

A keen FHA home loan is a federal government supported financial regarding Government Construction Management (FHA) and offered thanks to approved loan providers and banking companies. The program was a favorite certainly first-big date homeowners due to the down credit history and you will down-payment standards compared to the conventional money. FHA money endeavor to create homeownership economical, specifically for people who may not qualify for conventional mortgage loans.

Also get money, FHA also provides various re-finance choices for current home owners selecting beat their attention rate, otherwise dollars-out collateral to own home improvements otherwise debt consolidation.

As to why FHA Loans is Well-known Among Virginia Basic-Date Consumers?

First-time homebuyers usually face several pressures from protecting to own a down-payment to help you protecting that loan that have less-than-perfect borrowing from the bank. FHA loans target these issues actually, that is why they truly are popular. New versatile certification conditions and you may easy terms and conditions allow more relaxing for more people to get in the latest housing market.

Professionals of FHA Funds:

There are numerous benefits to choosing an enthusiastic FHA financing, particularly for earliest-go out homeowners. Listed below are some of one’s secret masters:

- Down Credit rating Criteria In lieu of traditional funds, which could wanted a credit score off 640 or more, FHA money is usually recognized having scores only 580.

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”2″>Shorter Deposit One of the most tempting areas of FHA fund ‘s the low down commission requisite. You could safer that loan having as low as step three.5% down plus 100% financial support can be done with approved advance payment assistance.

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”3″>Versatile Qualification Standards FHA money are designed to generate homeownership open to more folks. This means more flexible money and you can loans-to-money percentages no put aside requirements.

Drawbacks out-of FHA Finance:

While you are FHA money bring many advantages, nonetheless they have some disadvantages. Its vital to watch out for this type of before you make the decision:

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”1″>Home loan Insurance fees (MIP) FHA financing require one another an upfront and you may yearly (monthly) home loan insurance premium, that will add to the overall cost of the financing. Although not, a lot of regulators and you may traditional home loans wanted this in the event that down payment are lower than 20%.

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”2″>FHA Financing Restrictions Brand new apps has mortgage limits one differ of the area. This is often a regulation if you are searching to invest in a great higher priced home. The borrowed funds constraints begins within $498,257, however, many of one’s high-cost areas as much as DC instance Arlington and Fairfax, have higher financing restrictions doing $step one,149,825. Please find the condition by state Virginia FHA financing limits detailed regarding the graph below.

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”3″>Assets Conditions The house you might be to find need meet certain HUD criteria put from the the new FHA, which can restrict your possibilities. Specific apartments also needs to features an alternate FHA approval designation.

Wisdom Mortgage Insurance policies

Among the novel aspects of FHA fund is the requisite to own financial insurance rates. https://paydayloancolorado.net/floyd-hill/ There are two main section to that particular: