- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

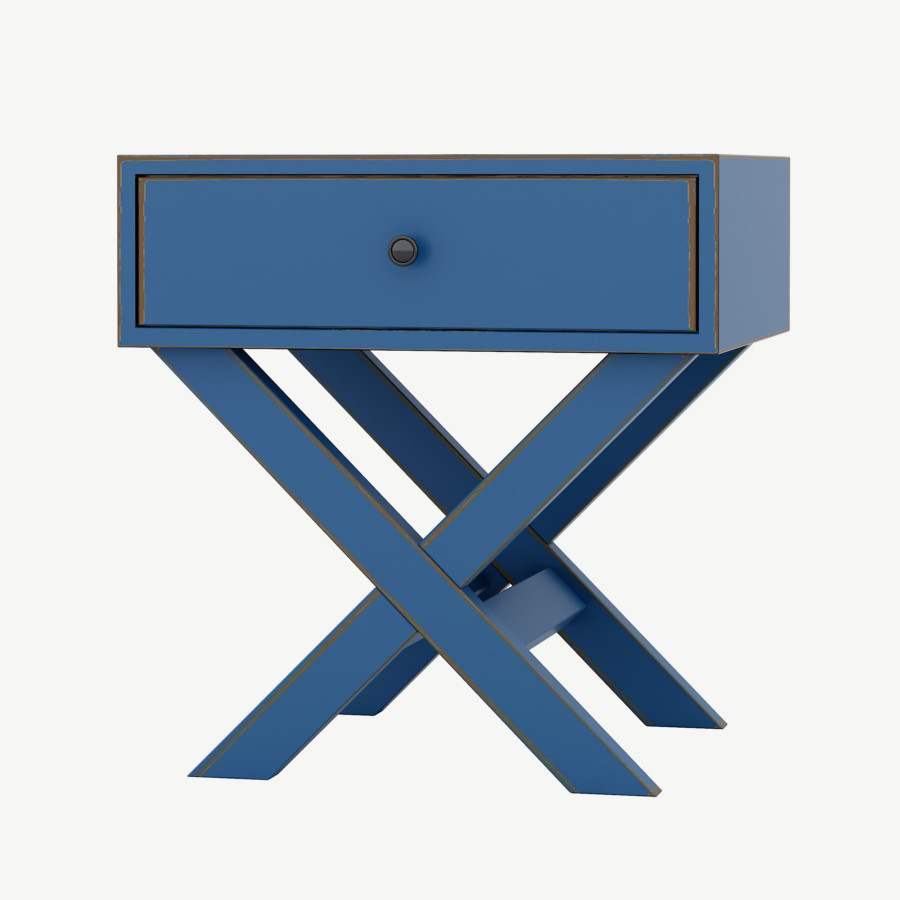

Piccolo Komodin

Piccolo Komodin

₺22,420.00₺16,575.00

-

- Yaşam Tarzı

How can i remove PMI immediately after I’ve bought a family?

Traditional PMI versus FHA MIP

Researching certain home loan solutions try a switch step up finding out how to cease PMI on your own mortgage. Incase evaluating the choices, you will need to understand the difference between PMI (private home loan insurance policies) and you will MIP (mortgage advanced).

PMI will be canceled when your loan’s prominent harmony falls in order to 80% of residence’s brand spanking new appraised worth. For property owners that have present PMI, refinancing would be an effective option to get rid of any kind of financial insurance policies, offered brand new amount borrowed was 80% or less of the latest residence’s current well worth.

FAQ: How to prevent pmi

Teaching themselves to end PMI as opposed to a good 20% downpayment can be done. That means are bank-reduced PMI, which usually results in increased home loan rate over the loan’s lifestyle. A new popular choice is the latest piggyback mortgage, in which a second mortgage facilitate financing area of the down-payment must end PMI. Likewise, pros have the advantageous asset of to avoid PMI without any downpayment from the Virtual assistant loan system.

Homeowners insurance protects your home and you will house out-of ruin or theft, coating repairs otherwise alternatives if required. Additionally provides accountability publicity however if somebody is hurt towards the your house. Financial insurance rates, while doing so, handles the lending company for those who default on the financing. Its normally called for if for example the downpayment is less than 20% of your house’s price, guaranteeing the lending company normally get well can cost you in case of foreclosure.

Of several loan providers you are going to waive PMI costs in exchange for a top financial interest. However, this may become costly than PMI over an excellent lengthened months. Understand how to avoid PMI without increasing your home loan rates, think either while making an effective 20% down payment or making use of an effective piggyback loan.

Yes, PMI is removed as soon as your mortgage equilibrium falls so you’re able to 78% of home’s brand new worth. You may proactively consult so you can terminate PMI payments when you come to an 80% loan-to-really worth ratio.

Jumbo financing, and this meet or exceed Fannie mae and you will Freddie Mac computer mortgage limits, dont constantly require PMI. Simply because they slip exterior standard advice, loan providers do have more independency with the finance. However, to eliminate PMI or equivalent criteria, loan providers might require good 20% otherwise larger deposit or proof extreme monetary supplies.

FHA finance don’t have PMI; as an alternative, they are available that have Home loan Insurance premium (MIP). Because MIP will become necessary towards the FHA financing no matter what down commission dimensions, the standard form of to avoid PMI by simply making good 20% downpayment doesn’t incorporate. The only way to eliminate MIP will set you back is by refinancing towards a traditional mortgage versus PMI when you have mainly based sufficient equity of your house.

Final thought about how to avoid PMI

Unraveling how to prevent PMI was a key action to own very first-date home buyers having below 20% down. The good news is that we now have a lot of an approach to bypass financial insurance.

If you wish to prevent PMI but don’t enjoys 20% down, correspond with a few loan providers regarding your choice. Its likely that, you can purchase away in place of PMI and possess a reasonable monthly payment.

- An effective 10% advance payment

When you’re wanting to know how to avoid PMI insurance rates, a common technique is to utilize provide currency to reach the 20% tolerance. Lenders will always create present money for use getting a good down-payment, but you can find conditions and terms. The newest current money need certainly to it really is feel a gift, not financing inside the disguise. Which results in anyone giving the current should provide a beneficial provide letter on the financial Jacksonville installment loan no credit checks no bank account, affirming that money is something special and never expected to getting paid off.

And even though PMI are the only choice when purchasing an effective new house, not to buy property is generally a considerably less fruitful resource if you think about that typically, a house has grown when you look at the really worth.