- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

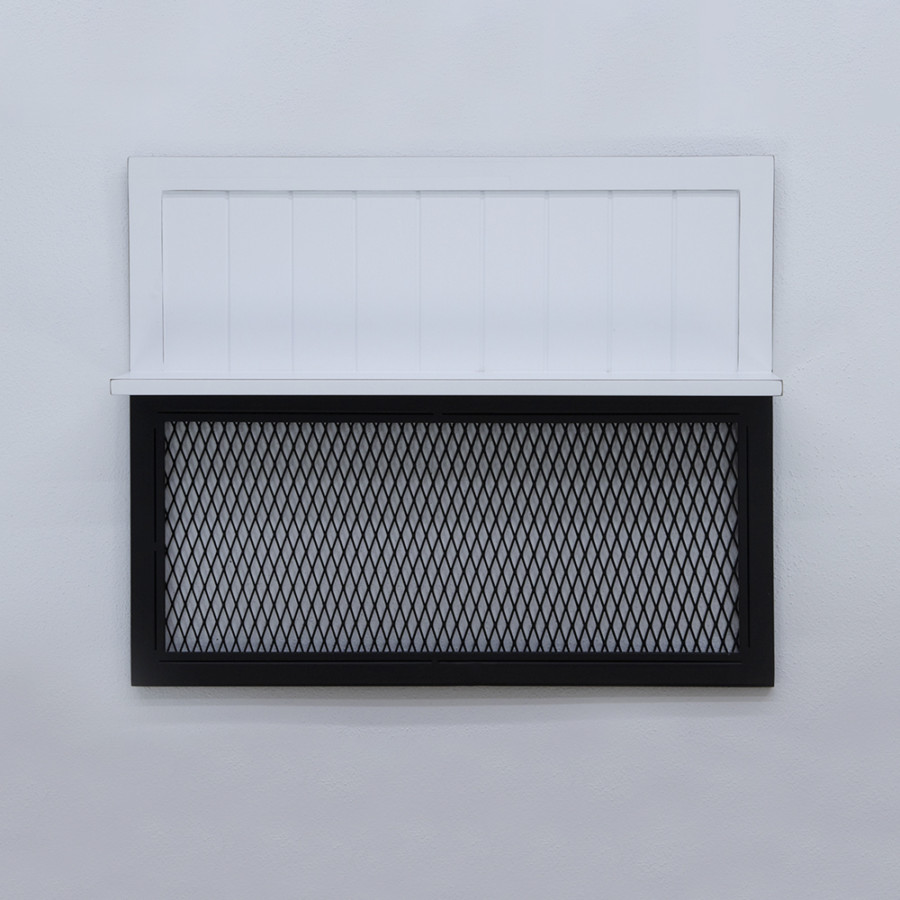

Hammond Duvar Rafı

Hammond Duvar Rafı

₺13,376.00₺10,342.80

-

- Yaşam Tarzı

Exceptions To your Latest Mortgage Not Depending Because Loans

Of a lot home owners contact us and get if they is book or promote their house. (Come across Can i Sell Otherwise Rent out My House? What is The Attitude?) He could be from inside the another type of matchmaking or a different sort of jobs and you will are ready to proceed to the next phase of the lifestyle. As we gauge the positives and negatives of the two possibilities, the question usually comes up “Can i rent out my house while having a different mortgage to buy an alternate one to? Exactly how will that it work?”

Just as once you taken out the first mortgage, the lending company took under consideration your revenue, the debt as well as your possessions available for a down payment whenever being qualified you for what you could pay for. Today your mortgage usually number because a personal debt and be factored on the algorithm for your the new home loan.

Therefore if your existing pay day loans Compo CT home loan is actually $1500 per month, which is a debt and that’s factored in the being qualified algorithm. Yes, I know your renting out your household and you can acquiring book to help you offset it obligations, but our company is into the conservative moments at this time and you can loan providers features to consider bad circumstances condition, we.age., let’s say that you don’t rent your house or if you has actually a multi-week vacancy, will you still be in a position to afford the the newest financial?

Yes, From the the nice days of the past – pre-2008, in the event your most recent financial wasn’t felt a financial obligation provided that as you shown a rent into possessions. The lender didn’t actually ensure the new book – people was in fact loose and crazy months. The good news is people are a great deal more traditional – loan providers, appraisers, etc. – and you’ll become also. That it conventional view of your existing mortgage is good for you since it prevents you against overextending yourself and having with the loans difficulties.

- Earliest, when you yourself have hired out your household having 12 months and you may can display 1 year out-of rental income in your taxation return, the bank doesn’t count your home loan debt towards the your this new mortgage.

- And you may, second, you could have an appraisal over on your property and if you have got sufficient collateral (constantly at the least twenty-five% equity) and you will a newly conducted book, the lender will count 75% of your rental earnings to simply help offset the mortgage payment.

Ask your bank from the these exclusions as they you can expect to are priced between bank in order to lender and you can loan program so you can financing system.

A residential property Blog site

Much of all of our property owners whom ask us which question are able to afford to buy an alternative home and you may rent the existing one. Brand new relationship or the fresh business contributes income that enables the fresh citizen to take each other mortgages and by hiring Chesapeake Possessions Management, the vacancy time and dangers are significantly less.

Thus, yes, it can all the exercise. But ask your financial these detail by detail inquiries before you can move ahead to your get.

Once you Meet the requirements to carry Two Mortgages, Local rental Income Could well be Welcome!

Then when we create rent your residence, the bucks disperse and you can rental earnings is actually a welcome introduction in order to the formula. as you have situated your buy for the old-fashioned wide variety, the latest rental money are bonus.

As effective as Chesapeake Property Administration is at cutting exposure when you find yourself controlling your house, we can’t take your chance down to zero so there will be periodic vacancy and you can solutions on the leasing household. By taking the conventional means, rather than the “rose colored” servings means, if unexpected turns up on your own local rental assets (good vacancy, an upkeep, an such like.), you will be able to manage they easily. A far greater disease for all parties inside it.

I’m hoping this helps. For much more detail by detail solutions regarding the certain mortgage condition, we strongly recommend your speak with Jen Orner from the PrimeLending.