- Tüm Ürünler

Mutfak

- AksesuarlarModern Items

Oturma Odası

- MutfakMutfak

- Oturma Odası

- Yatak OdasıOutward

- BanyoEssentials

- Çalışma OdasıInternal

- Giriş MobilyasıPart and Parcel

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

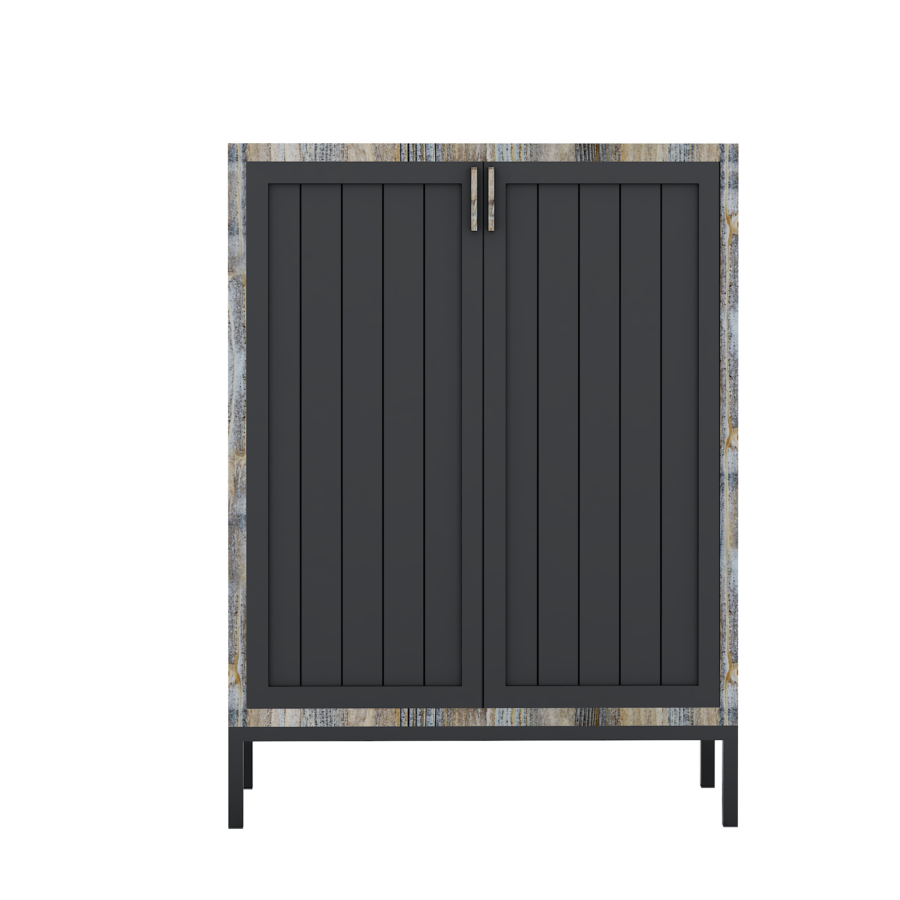

Ladin Dolap

Ladin Dolap

₺40,280.00₺33,150.00

-

- Yaşam Tarzı

- Blog

- Projeler

Look for your own custom mortgage selection having Compass Mortgage

If only one lover is actually on the home loan and borrowing from the bank spouse would like to move out, the new non-borrowing mate would need to re-finance the mortgage.

In any event, if you get a divorce, you will have to complete the divorce decree into the financial to maneuver give along with your options.

Who is sensed a non-borrowing from the bank companion?

- Hitched to the borrower at the time of the new loan’s origination

- Founded while the an eligible, non-borrowing partner with a loan provider in the conception of loan

- Fulfill the conditions towards the contrary mortgage, in addition to keeping the home and you will expenses fees and you may insurance policies

When you’re indexed as the a qualified, non-borrowing lover therefore plus spouse get a splitting up, the choice to stay in the house hinges on their contrary financial conditions and breakup contract.

Have a tendency to, your best option having a spouse who wants to stay-in our home it is perhaps not indexed as good co-borrower is to re-finance the borrowed funds.

What takes place if you get remarried?

When you have a contrary mortgage and in the future marry again, your new spouse will not have HECM protections for those who flow away or pass away.

Within this circumstances, you need to re-finance toward a separate loan therefore the the latest spouse is going to be put in the loan, sometimes since the a co-debtor (when the qualified) otherwise due to the fact a qualified, non-borrowing mate.

The new friendly, educated loan advantages from the Compass Financial are prepared to make it easier to and additional talk about their reverse financial possibilities.

The Compass Financial class snacks our very own individuals instance family members. All of our core viewpoints-perfection, stability plus the infinite property value visitors i meet-was which we’re and exactly how i conduct business..

We might always speak with one to speak about the contrary financial options which help your discover the top advantages which mortgage proposes to people that qualify.

Submit an application for an opposite home loan now available you with very first information about your self along with your property, otherwise call us at the (877) 635-9795 to talk to a loan manager today.

Split up are going to be tricky – one another financially and you will mentally. Leading to the brand new challenging techniques try behavior you must make regarding your house and you can financial. The fresh marital house is usually the asset with the premier economic really worth, thus deciding ideas on how to equitably split a house results in clear argument. However, home loan repayments do not stop from inside the divorce process, and ultimately, it ought to be felt like who happen to be responsible for new mortgage payments. If you are considering a separation and divorce, and have now questions regarding their courtroom and financial legal rights because it identifies your residence and home loan repayments, thought going to having a skilled Tx friends laws attorneys within Tx Divorce or separation Legislation Class within (720) 593-6442 now.

Divorce case along with your Mortgage Choice

Should your label in your home has the name of one another spouses, then each other spouses will remain in charge to blow the new financial, in the event one to mate motions away according to Tx rules. As well, taxation or any other obligations for the domestic are nonetheless the brand new financial obligation away from each other spouses before the finalization of your own splitting up.

But not, there are a number off choices for how two could possibly get handle a relationship house inside the a splitting up, and these rely on things for example credit scores, family security, and you can though one party desires to stay static in this new household. Listed here are the most used choice that divorcing partners thought about your marital household.

Re-finance your house

After assets and you may expense are entirely calculated and you can determined, an effective divorcing couples tends to loans Hackneyville make the choice to refinance a together held mortgage into a single title. Which leads to that spouse retaining ownership of the house as the well while the obligations to spend the borrowed funds of the home. Additional spouse might possibly be free of one mortgage responsibility and you will its title removed from the identity.