- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

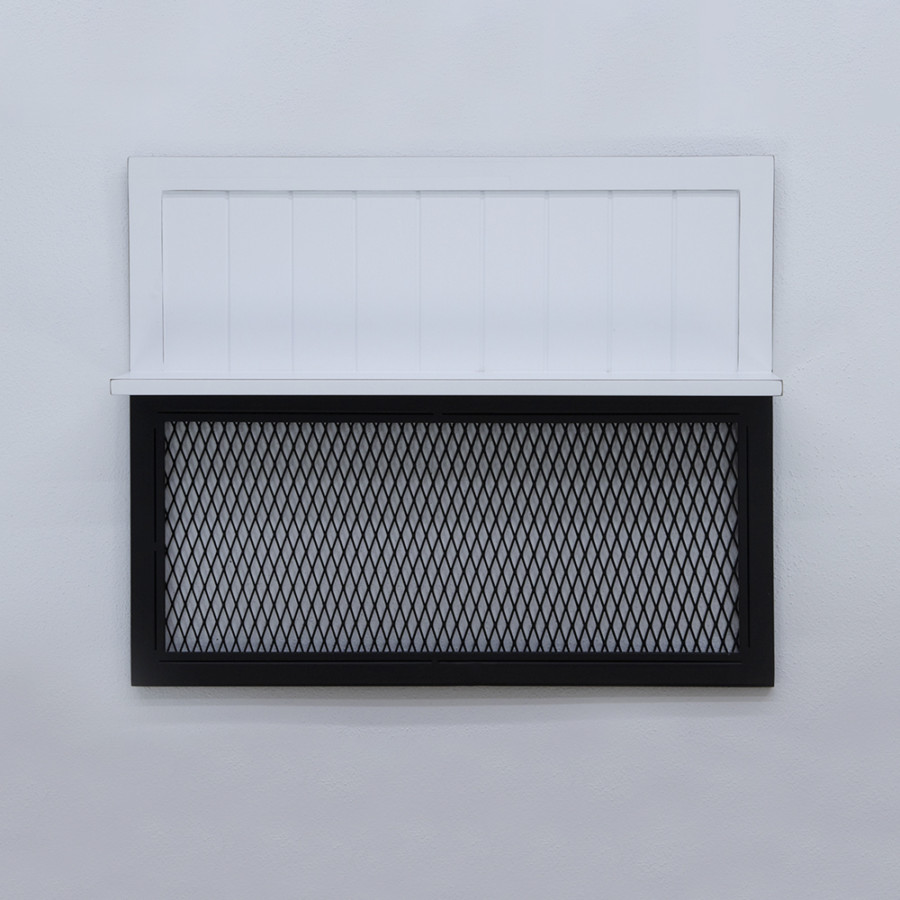

Hammond Duvar Rafı

Hammond Duvar Rafı

₺13,376.00₺10,342.80

-

- Yaşam Tarzı

Is financial feel transported in one person to an alternate?

Heat Reflecting Painting

As you probably know more Indians like to pull out a home loan to acquire where you can find their goals. It is being among the most regular financing models when you look at the India. Although not, area of the concern that most those people who are unable and then make its mortgage repayments provides are: Ought i import my personal financial to another person?

The answer was sure, just like the has been said a lot more than because of the folk. They are able to accomplish that by promoting our house into the newest customer, settling their loans thereupon currency, and you will moving control for the client’s title.

How will you import a home loan to some other individual?

There are various strategies experience acquisition to make sure an excellent simple transition whenever mobile a home mortgage to a different person.

People that need certainly to transfer the mortgage need to be sure into the financial that the mortgage individual meets the prerequisites in fact it is in a position to of handling the monetary load.

You can glance at the techniques concerning your going out of an excellent mortgage to a different people provided with Mandeep Singh over. The guy explained the methods really well. I’m hoping you receive so it respond to useful.

Temperatures Highlighting Color

Whenever you are wondering try home loan move into other person you can or otherwise not, let me tell you that it is you can. A property manager has the substitute for designate your debt so you can a separate cluster if they select to not ever remain and make loan repayments. Yet not, that merely are present in case your manager sells our home so you’re able to yet another visitors and you may organizes into import out-of ownership so you can the second.

Before you can learn how to import financial to a different individual, the dog owner, who’s also known as the vendor, need to pay away from their personal debt. For this reason, new proceeds from the brand new profit of the property to your the fresh consumer can be utilized of the vendor to repay this new loan. Such import, identified regarding banking globe just like the an internal harmony transfer, generally requires the same bank.

Tips transfer mortgage from a single person to another type of?

Getting learning to transfer mortgage in one person to a special inside the Asia, brand new formalities in inner Mortgage Balance Transfer is actually given that employs.

As opposed to attempting to sell the house, the consumer need to query the current manager to include a page verifying the brand new loan’s foreclosures.

While the the property might possibly be directed from a single proprietor to another, a small grouping of experts usually consider it legally and you will technically. The value of the house or property could well be influenced by this new tech testing.

The loan count will be presented into the the newest client since the the main sales attention. The financial institution commonly issue a good cheque on vendor just like the fee.

Owner must also give the client photocopies of the home-related papers at the same time. Original copies would be for the bank.

Heat Reflecting Painting

To begin with my personal answer about your ask, do i need to import home loan to a different individual? I wish to declare that it is imaginable, yes. A property owner comes with the choice to designate your debt to yet another group once they decide never to continue and make loan repayments. Yet not, that can simply occur if your manager offers the house to help you yet another client and arranges into transfer from control so you’re able to aforementioned.

Through to the import, the particular owner, that is known as the seller, must pay regarding his or her financial obligation. Thus, the fresh proceeds from the brand new purchases of the property on the new client can be utilized because of the vendor to pay off brand new financing. These import, recognized regarding the banking globe just like the an interior harmony transfer, typically requires the same lender.

Instead of selling the property, the buyer need to query the present day manager to incorporate a page verifying this new loan’s foreclosures.

Because the property is transferred from one owner so you can an alternate, a team of experts usually have a look at it lawfully and commercially. The value of the home was dependent on the fresh new technology comparison.

The vendor should also allow the visitors photocopies of the home-associated papers meanwhile. The initial duplicates was towards lender.

can we transfer mortgage from person to a different sort of, plus the formalities employed in import, allow me to together with focus on that the courtroom and you will technical confirmation, and the credit assessment, will go a lot more quickly with the same bank, hastening the performance of your import. It is because all assets documents is to your same financial.

Heat Reflecting Decorate

One of the most challenging issues one haunts your mind try what the results are towards home loan immediately following dying. Who’ll pay-off the loan? Often the lending company seize the property? Better, more often than not if there is a great pre-existing financial in addition to owner have died, the mortgage will get transferred to the fresh new courtroom heirs. So, inside perspective I could reveal to you the procedure of home loan move into another individual.

Get back home mortgage out of your common bank by way of NoBroker and steer clear of large papers! What’s the way to financial transfer from individual to some other if proprietor has lifeless?

If there’s an excellent co-applicant, the mortgage might be relocated to the newest co-candidate simply. If there is no co-candidate after that courtroom, that is, this new daughter or son repays the borrowed funds. Contained in this procedure, the financial institution associations mortgage guarantors and court heirs to settle the fresh EMI. Within these criteria, it has flexibility to possess installment. You could visit the lender and request having reorganizing the fresh new funds otherwise make a-one-day payment. Any individual who’s bringing the obligations to take the house mortgage pursuing the death of the owner need a reliable money.

That is a different sort of processes for home loan might be moved to someone. I’m sure this really is a while off question however, We noticed including sharing everything here. I really hope 5000 payday loan no credit check you adore they.