- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

Modul 1 Ada Mutfak

Modul 1 Ada Mutfak

₺37,240.00₺28,906.80

-

- Yaşam Tarzı

Dominant and you can attention compared to interest just: What’s the distinction?

Skills your loan payment alternatives is very important when you take aside a great mortgage. Two common choices are dominant and you may appeal (P&I) and you may desire-merely (IO).

Selecting the most appropriate mortgage payment solution can feel overwhelming, especially when contrasting prominent and focus (P&I) that have desire-merely costs. Both options have the benefits and drawbacks, it is therefore very important to property owners and you will buyers to understand the new specifics.

Inside a primary and you will appeal loan, you happen to be chipping out at both the matter you borrowed (the main) together with desire which is stacking right up. Its a while such as for instance a constant rise, slowly cutting your debts and receiving your closer to sooner running your house downright. On the bright side, with an intention-merely loan, your own initially costs are just within the interest the main doesn’t policeman a damage. While this may seem such as an effective breather for the bag from the very first, you aren’t in reality bringing one closer to buying your home through the this focus-merely period, while the you are not building any security in your home.

What is dominating and attract?

Dominant and you can appeal costs (P&I) is the typical type of financial payment. For each percentage you will be making goes with the decreasing the dominating (extent borrowed) therefore the appeal charged of the financial. Very first, a more impressive portion of the installment covers the attention, but over the years, once the dominating decrease, the interest parts minimizes, and more of one’s fee goes to the settling the primary.

Your loan’s apr (ount interesting you only pay. So it rate is split up by 365 to find the every single day attention charged on your newest financing harmony. While you are appeal accrues everyday, its normally recharged monthly. New every day appeal costs for the entire few days is then added to one another to make your own complete month-to-month appeal fee.

No matter whether you create payments a week, fortnightly, or monthly, they contribute towards one another focus and you will principal. As you slowly pay down the main, the remainder mortgage harmony on which interest is calculated decreases. This can lead to a steady reduced the month-to-month desire repayments, if in case the rate remains lingering. Yet not, it is critical to keep in mind that the specific amount online loans Piedra, CO of interest charged per month is a little vary as a result of the some other number of months during the per month.

Advantages of dominant and you will attract

Guarantee building: As you lower the primary, your improve security about possessions, and therefore you can easily individual the house or property outright much faster.

All the way down attention can cost you: Along the life of the loan, you can pay reduced during the notice compared to notice-simply loans, given that dominant decreases with every percentage.

Lower interest: The pace into the a main and you may attention mortgage can be lower than the pace into an appeal just loan since P&We financing try perceived as much safer.

Disadvantages away from principal and focus

Large initial payments: New combined prominent and you can focus payments is more than notice-simply repayments, which can set a-strain your small-name finances.

What is actually desire merely?

Interest-only costs signify, to own an appartment period (usually ranging from one and five years), the loan money merely safeguards the attention with the financing, maybe not the primary. That it contributes to straight down monthly installments inside the desire-simply months. After this several months comes to an end, the mortgage reverts so you can prominent and you may attract costs, and/or loan must getting refinanced.

Advantages of desire only

Money freedom: Of several buyers choose appeal simply financing whilst frees up bucks which can be spent somewhere else for a potentially high go back.

Income tax pros to possess buyers: Appeal repayments with the an investment property might be income tax-allowable in australia, which can be beneficial to own possessions buyers.

Drawbacks interesting just

Large overall interest will cost you: Over the longevity of the borrowed funds, you’re going to be expenses far more inside the attract since the dominating actually low in the first age.

Percentage treat: In the event that mortgage reverts to prominent and you may focus costs, you can face a significant increase in monthly obligations.

That is better, prominent and you will interest or appeal simply?

If you are to relax and play the newest enough time video game, seeking to fully individual your property and build security, a primary and you will notice loan is the better option. It is an excellent steeper climb up up front having high monthly obligations, but consider it since the a powerful resource on your own upcoming. Through the years, you’re not only repaying an obligations; you might be strengthening a nest-egg. The genuine winner this is basically the a lot of time-name deals, due to the fact you will be using shorter appeal along the lifetime of the mortgage.

On the other hand, of a lot buyers who want deeper income flexibility and you will tax pros in the early years opt for attention merely payments. The only catch here’s that once the eye just months wraps up, you will be to investing both principal and you can attention, that’s a critical hike on the payments. Along with, you’re not strengthening any collateral inside attention-only stage, that is a downside should your possessions doesn’t upsurge in worth.

Very, that’s better? Better, it is really not a single-size-fits-most of the respond to. If you are looking to create guarantee and generally are more comfortable with large 1st repayments, dominating and you can notice was a strong wager. But when you you would like autonomy on your finances today and they are focused on most other economic needs or expenditures, interest-merely you’ll last better for a while.

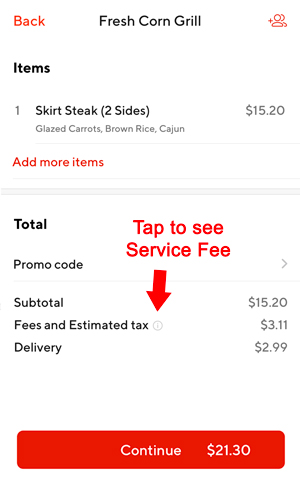

To acquire a home otherwise seeking to re-finance? The brand new dining table lower than keeps lenders which includes of the lower interest rates in the business to have owner occupiers.