- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

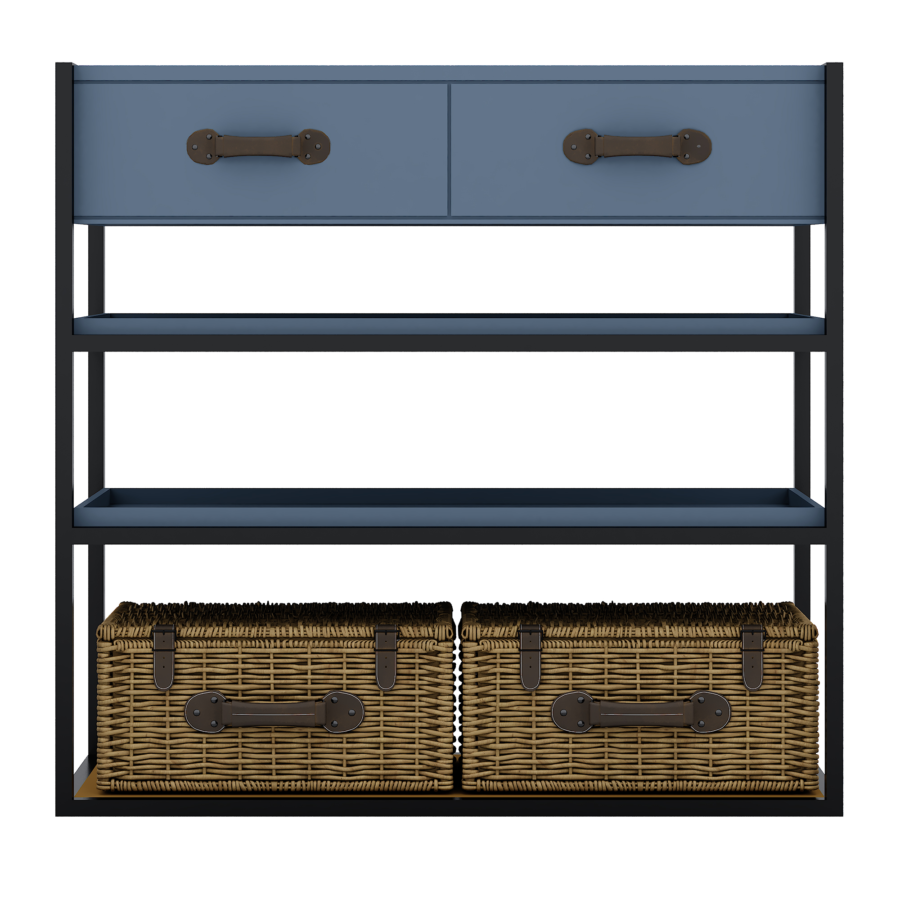

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

Charlotte Va Mortgage Techniques and you can Detail by detail Guide

Virtual assistant home mortgages are a great option for Charlotte homebuyers having qualifications. Indeed there aren’t of numerous financing programs that provide 100% resource without financial insurance for the Mecklenburg County. Bringing pre-accepted to possess a great Va mortgage is even easy by way of improved sleek operating.

Once you influence the fresh new Va mortgage suits you, doing the mortgage approval processes can help you in minutes. This step involves a number of actions: shopping for a prescription Virtual assistant bank, pre-being qualified on the Virtual assistant mortgage, interested in your property, writing a purchase package, having personal loans Idaho bad credit the possessions appraised because of the Va, and you will finalizing the mortgage closure.

- The brand new applicant should be an eligible experienced who’s available Va entitlement.

- The fresh experienced must consume otherwise want to undertake the property just like the property inside a good time frame after closing brand new financing. The loan can’t be used for financing or second home instructions.

- All of the people should have credible borrowing from the bank – basically more 600 credit score for almost all lenders and banking companies.

- Money of your own domestic need to be proven to be sufficient to meet up with the loan costs, and you can protection the expense out of owning a home. Va, like all mortgage brokers, have maximum allowed debt to earnings rates. The mortgage financial will be able to explore certain money and you can almost every other being qualified requirements.

- Know very well what mortgage name and down-payment (or no) you prefer.

How to locate an effective Virtual assistant Approved Lender or Bank in Charlotte, NC:

Prior to starting the program procedure, it’s smart to rating a duplicate of your credit report. This really is taken from among the many around three major borrowing bureaus – Experian, Equifax, and TransUnion. After you have your credit report, the next thing is to acquire a beneficial Virtual assistant-accepted lender – ideally individuals local to help you NC. Per condition has many twists and converts, it is best to functions in your area having a lender your believe.

Getting recognized to have an effective Va financial:

Pre-qualifying to have good Virtual assistant loan is best treatment for determine exactly how much borrowing stamina you really have. Pre-qualifying relates to doing a good Va application for the loan. Centered on one to pointers, you can find out for people who be eligible for a given financing. Note that pre-being qualified merely offers a quotation of one’s number of mortgage payment you really can afford, in line with the pointers your render. If you find yourself pre-qualifying isn’t a necessity, it’s recommended.

Without pre-qualifying basic, you may find your self deciding on households that you wouldn’t necessarily manage to pay for. When you pre-be considered, you have an effective thought of how much income you will want to qualify. Additionally, you will know what spending budget from homes you can would, that’s very important to the next step.

Choosing the Primary Home:

Right now you’ve been Va home loan pre-approved and have now smart of the purchase price point. Anybody can initiate the whole process of wanting your new house. Looking a house can be done in several ways:

- Online: There are many internet sites dedicated to record virginia homes. This page are usually employed for seeking property that will be away of one’s travelling variety, and frequently become several photos and more information. Zillow and you may Realtor was both higher options to browse on the web.

- Having fun with a representative: Once more, Zillow or Real estate professional is a fantastic approach to finding a professional realtor. The majority of people explore real estate agents to browse from paperwork involved in to find yet another house. Information away from nearest and dearest, etcetera. also are a powerful way to select a representative.

Also known as a beneficial “conversion process package” or “pick agreement”, new file means the fresh finalized conditions and terms where the newest import away from home will require set. A purchase price is essentially a contract involving the customer and you may provider to get our house into the decided-upon words, what they ong whatever else target: restrictions and you can easements, liens into the property, checks, earlier leases, disclosures, making preparations out of records to have closure, and you may repair of the house around closing.

Va Family Appraisal:

The bank will purchase the house appraisal as soon as your bargain is actually over. This is certainly had a need to execute the loan, since the home should be worth the price. It’s important to remember that because the Virtual assistant appraisal rates the worth of the house, this is not a check and does not ensure that the fresh home is clear of problems. Homeowners is to hire an established domestic inspector to help offer everything you a closer look. Virtual assistant promises the borrowed funds, perhaps not the condition of the house – be aware of so it.

Virtual assistant Mortgage Payment:

When your assessment is suitable to all or any people and financial establishes your financing is approved, this new Virtual assistant closing procedure begins. Most of the parties look at the mortgage closing and you will signal the brand new notice, home loan or other related documentation. The lender and you may title broker, or closing attorney will explain the borrowed funds terms and requires while the well while the where and the ways to make monthly payments. If mortgage try advertised into the Va, the new Certificate out of Eligibility try annotated so you can mirror the application of entitlement and you may returned to the brand new Seasoned. The loan closing techniques can vary in a few claims, however, adopting the signing, your loan usually finance and you also receive the keys!

Need some assistance with an effective Virtual assistant mortgage within the North carolina? Please contact us by submission brand new “Quick Request Mode” on this page. Or contact us 7 days per week at Ph: 904-342-5507