-

×

Eskitilmiş Gri Hazeran Çekmeceli Dolap

1 × ₺31,200.00

Eskitilmiş Gri Hazeran Çekmeceli Dolap

1 × ₺31,200.00 -

×

Monaca İkili Sehpa

1 × ₺15,210.00

Monaca İkili Sehpa

1 × ₺15,210.00 -

×

Monaco Mini Konsol

1 × ₺31,980.00

Monaco Mini Konsol

1 × ₺31,980.00 -

×

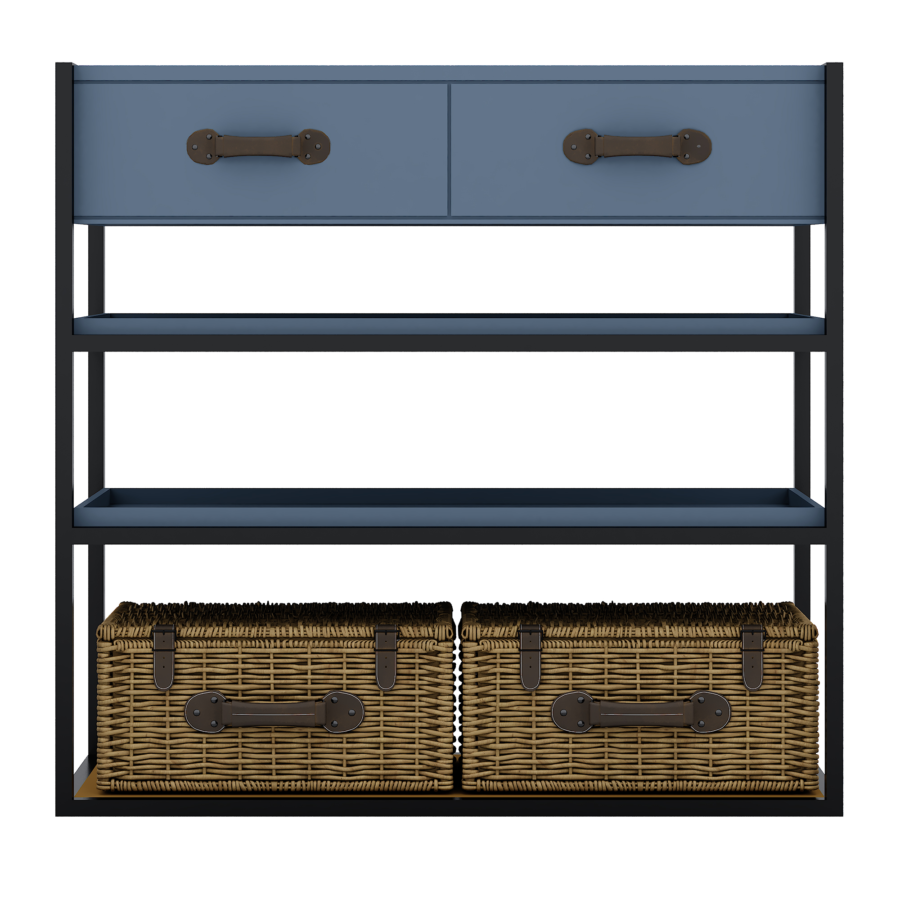

Atlas Dresuar Kitaplık

1 × ₺36,465.00

Atlas Dresuar Kitaplık

1 × ₺36,465.00 -

×

Atlas Dresuar Kitaplık

1 × ₺34,144.50

Atlas Dresuar Kitaplık

1 × ₺34,144.50 -

×

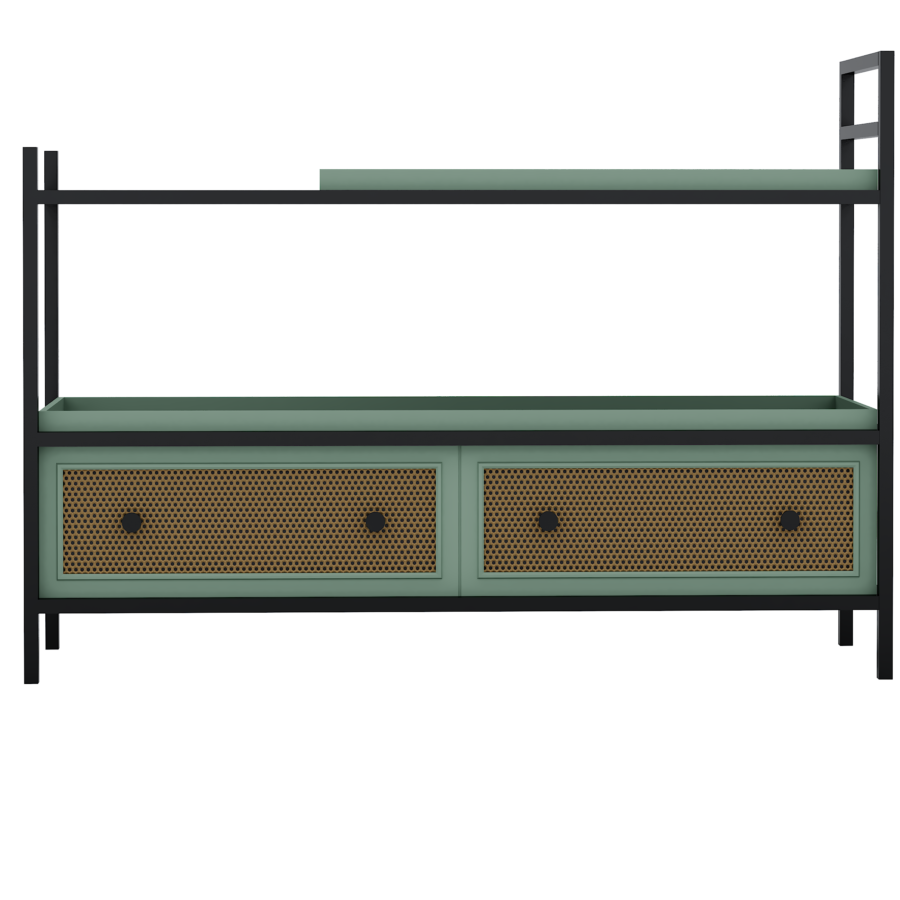

Hazeran Çekmeceli Dolap

2 × ₺47,537.10

Hazeran Çekmeceli Dolap

2 × ₺47,537.10 -

×

Eskitme Gri Hazeran Çekmeceli Dolap

1 × ₺47,537.10

Eskitme Gri Hazeran Çekmeceli Dolap

1 × ₺47,537.10

Ara toplam: ₺291,610.80